bear trap stock example

Bear traps occur when investors bet on a stocks price to fall but it rises instead. All things considered the financial backer may trail.

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

A typical bear trap works like this.

. For example in the past poker legends like Doyle Brunson would just play only the top hands and play it very tight to win. This is a perfect example of a support level bear trap. Bear traps spring as brokers initiate margin calls against investors.

In significant bear trap trading scenarios a bear trap can open the door to a short squeeze. A Bearish Bear Trap Candlestick Breaks the support level and goes down but closes above the support level. A bear trap is a market circumstance where merchants anticipate that downward movement should proceed after an unexpected help breakout however the market shifts direction.

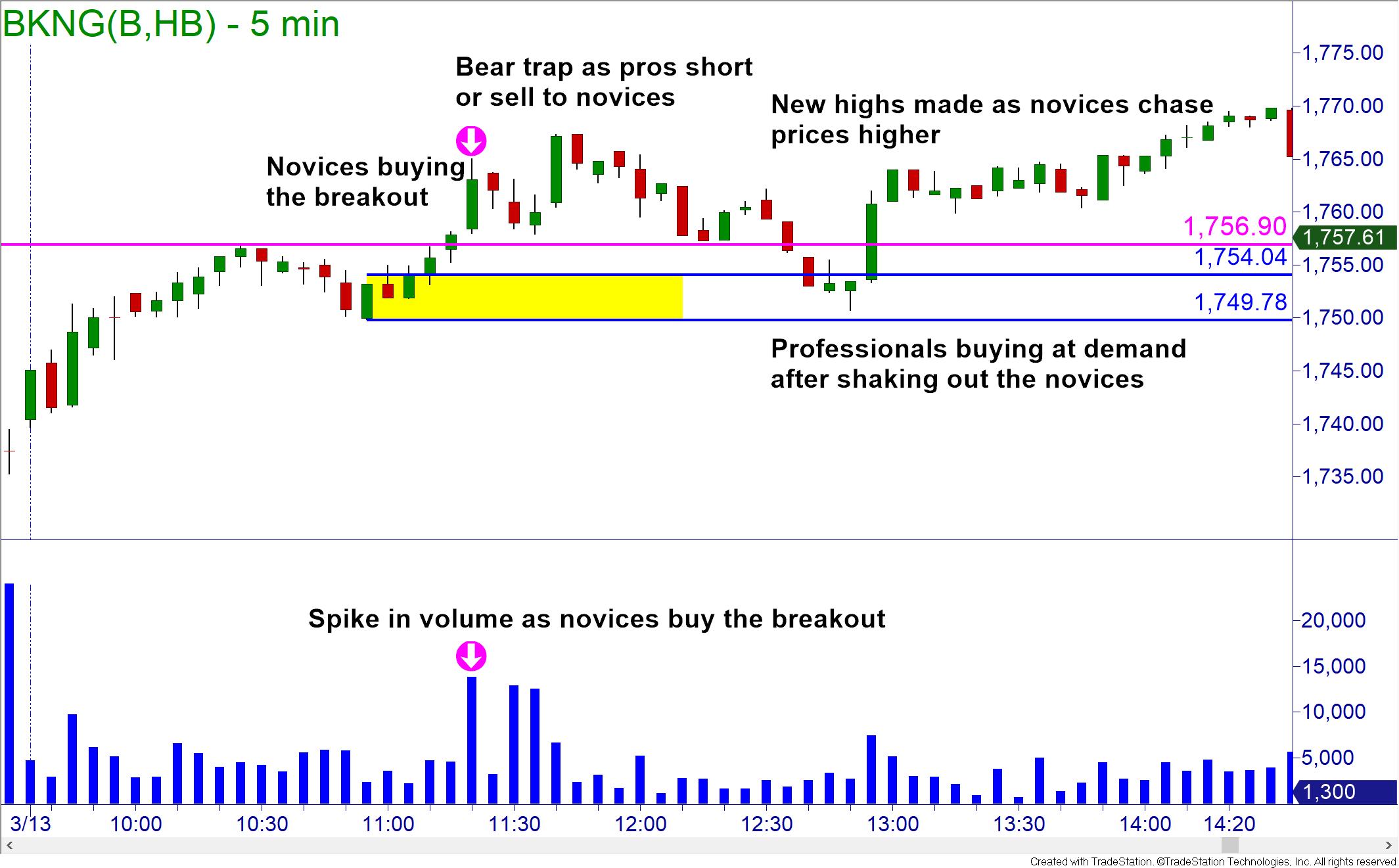

Thats because in illiquid stocks theres usually only one or two big players. A Bear Trap is a deliberate move by the big institutional players to trap traders into thinking there is a Short trade. This is another example of a bear trap stock chart which could be easily recognized with simple price action techniques.

Plenty of people have lost money in the stock market and one of the ways that happens is through a bear trap. This is the prime example of a bear trap in financial markets. Bear Trap Example.

These 3 bear traps chart formations provide really good buy signals especially if they form. In general a bear trap is a technical trading pattern. A bear trap results in a stock that appears to be taking a turn for the worse only to rebound quickly.

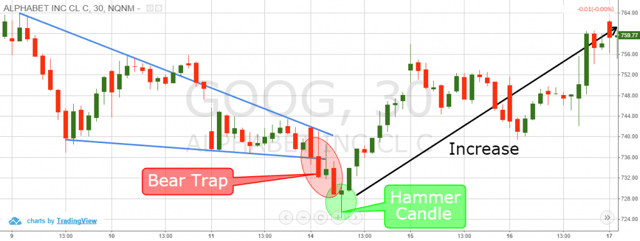

The RSI is an oscillator that measures. Bear Trap Stock is a term used in the stock market to describe a particular type of investment. Bear Trap and Price Action Trading This is the 30-minute chart of Google for the period Dec 9 17 2015.

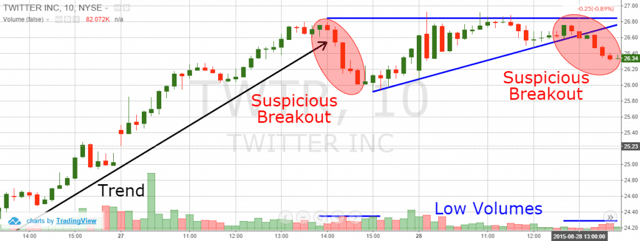

Below is another example of a bear trap with Twitter TWTR. For example intraday in forex markets or over several trading periods in the stock market. The easiest way to trade bear and bull traps is to first identify the major market support and resistance levels.

Identifying a Bear Trap. Our price action analysis suggests a double bottom bear trap formed in NIO stock in the May sell-off. How to Avoid Bear Traps.

Typically betting against a stock requires short-selling margin trading or derivatives. When you see a trap has formed with price making a fake move out of one of these levels you can enter trades in the opposite direction. Bear trap trading is the unanticipated behavior of a stock that lures bearish investors into false positions that can hurt your portfolio.

Bear trap example Suppose youve. As we stated earlier the key is not to fall into one. Example of trading the bear trap pattern.

You will notice that the stock broke to fresh two-day lows before having a sharp counter move higher. Identify Bull Traps and Bear Traps with Relative Strength Index RSI One way to identify a potential bull or bear trap is by calculating the relative strength index RSI of the asset. This technical indicator allows you to check if the stock or cryptocurrency asset is overbought underbought or neither.

Here are some of the popular strategies to identify a bear trap. It can be harmful to investors taking a short position in the market. The stock has produced a total return of 748 over the past 12 months compared to -03 for the S.

A bear trap is where a stocks price. After the support is put in place just below. Bearish Candlestick Closing Above Support.

Disney posted revenue of 1925B in its recent FQ2 up 233 YoY but down from FQ1s 343. It also highlighted robust order book visibility in May. Divergence is the condition when the technical tool and the price action no longer show the same momentum.

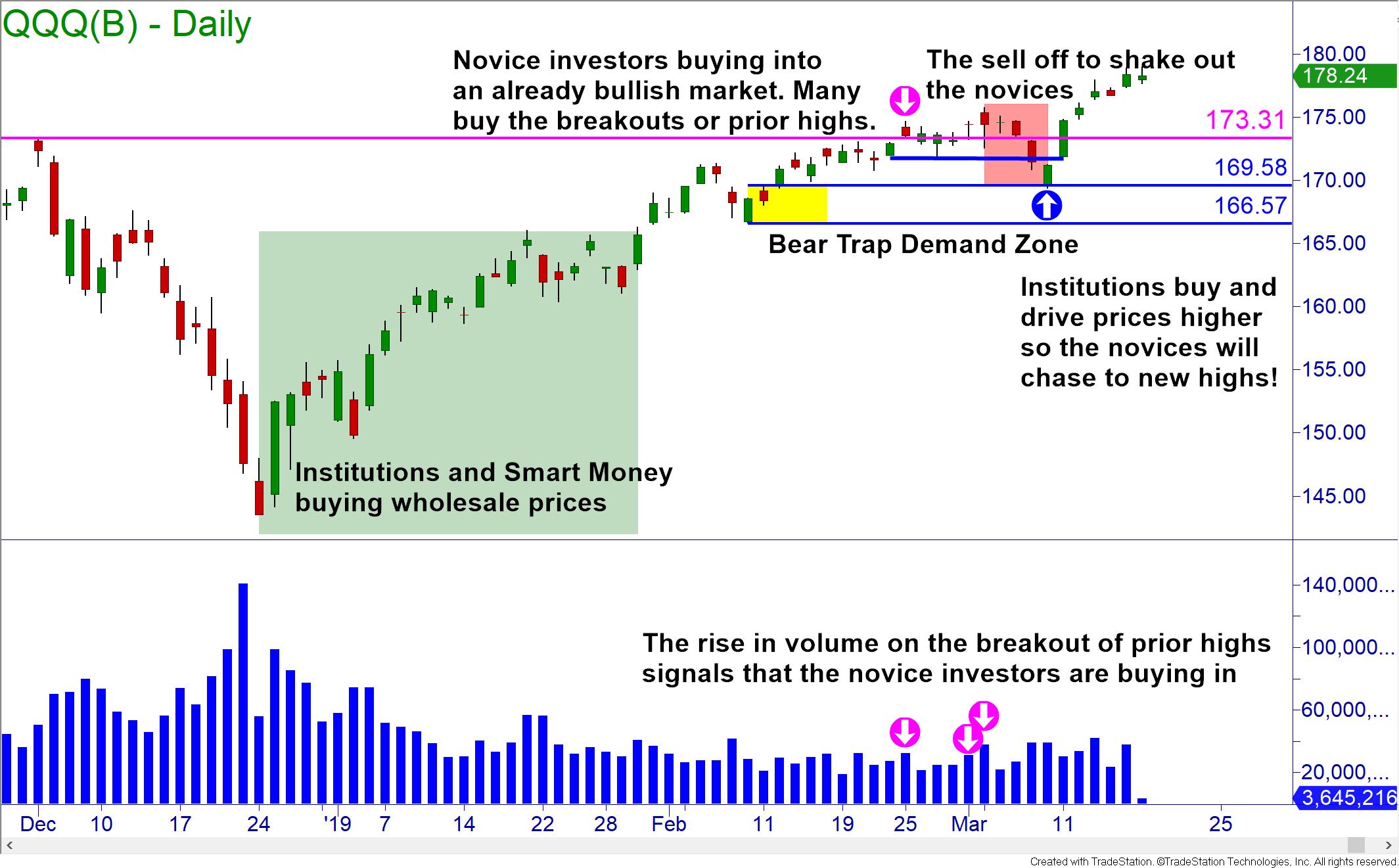

The bear and bull trap are created by the major market players. When a stock is starting to reverse approaching new highs or new lows the volume will accelerate. A bear trap stock is a downward share price that lures investors to sell short but then sharply reverses with the price moving positively.

The bear trap is a tricky market situation that involves the potential of losing money. Notably the companys revenue growth for the full year is expected to reach 251 boosted by easier. This occurs when the false reversal happens quickly and dramatically sending a stocks price much higher than anticipated.

If you managed to identify a bear trap you should wait for the formation of a bullish candlestick. Therefore we are confident that its. Below is an example of a bear trap on 76 for the stock Agrium Inc.

Imagine were in the middle of a bull market and youre one of the inexperienced traders looking to cash in on your investment. Bear Trap into a Short Squeeze. 3 Types of Candlesticks in Bear Traps 1.

The best way to avoid a bear trap and avoid loss is to identify a bear trap and take positions accordingly. Here is the example of that situation shown below by this bear trap chart. Rising stock prices cause losses for bearish investors who are now trapped.

Bear Trap Chart 3. If you see price make a false break of a major support level you could then look to. This is an excellent illustration of a market volume bear trap.

A bull trap is a false signal indicating that a declining trend in a stock or index has reversed and is heading upwards when in. Still if you know how to turn the situation in your favour you have chances to come out ahead. Lets now go through another bear trap example which we can avoid with simple price action knowledge.

The cryptostock prices that youre following only keep on rising so you havent sold any of your assets yet in the hope of getting a bigger profit. The cost strongly decreases and breaks the help level which draws merchants who accept the downtrend will proceed. 3 Types of Candlesticks in Bear Traps.

After the support is put in place just below 084 EURGBP moves higher but finds resistance at the 50 SMA yellow. You will encounter many bear traps during your trading career. 1 day agoSome Wall Street experts say it could be a trapand the bear market will still wreak havoc.

It happens when the price movement of a stock index or other financial instruments wrongly suggests a trend reversal from an upward to a downward. The next 1 or 2 candlesticks are bullish.

What Is A Bear Trap On The Stock Market Fx Leaders

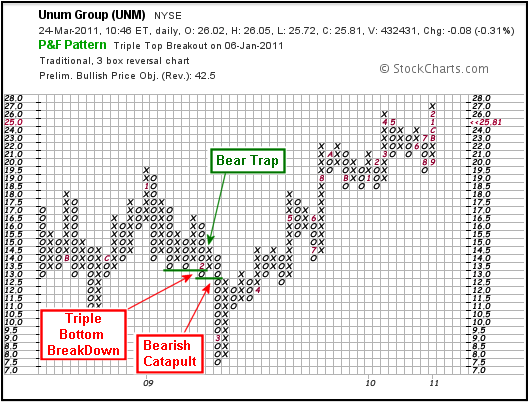

P F Bull Bear Traps Chartschool

Don T Get Caught In A Bull Trap Tips To Avoid Getti Ticker Tape

Bear Trap Stock Trading Definition Example How It Works

What Is A Bear Trap On The Stock Market Fx Leaders

The Great Bear Trap Bull Trap Seeking Alpha

What Is A Bear Trap On The Stock Market

What Is A Bear Trap On The Stock Market Fx Leaders

What Is A Bear Trap On The Stock Market Fx Leaders

Bull Trap Vs Bear Trap How To Identify Them Phemex Academy

What Is A Bear Trap On The Stock Market

What Is A Bear Trap Seeking Alpha

The Great Bear Trap Bull Trap Seeking Alpha

What Is A Bear Trap On The Stock Market Fx Leaders

3 Bear Trap Chart Patterns You Don T Know

What Is A Bull Trap In Trading And How To Avoid It Ig En

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

The Bear Trap Everything You Ve Ever Wanted To Know About It